Les marchés financiers inquiets sur la capacité de la Chine à maintenir sa croissance et à contrôler la dépréciation de sa devise

La spéculation à la baisse s’est récemment renforcée sur le yuan (ou renminbi) et certains analystes n’excluent plus une action concertée des banques centrales pour éviter un krach de la devise chinoise dans quelques mois.

Les évolutions de trois indicateurs sous-tendent cette hypothèse :

- Une hausse des primes des options de vente de yuan ;

- Des tensions entre le yuan domestique contrôlé par la banque centrale (CNY) et le yuan offshore coté à Hong Kong (CNH): de novembre à décembre 2015, l’écart entre ces deux cours est passé de 0.3% à 0.6% ;

- Une diminution historique des réserves de change, mobilisées par les autorités pour soutenir leur devise en l’achetant sur le marché, sur l’année 2015 (-513 Md $) et particulièrement en décembre (-108 Md$, plus forte baisse mensuelle depuis 2004). Ces réserves sont tombées à 3 300 Md$ contre 3 990 Md$ en juin 2014, alors que le seuil de sécurité selon certains analystes se situe à 2 800 Md$.

Par ailleurs, le contrôle du taux du yuan par la banque centrale chinoise devrait continuer à se relâcher dans le cadre de son intégration au panier des DTS (Droits de Tirages Spéciaux) du FMI, qui inclura le renminbi à partir de septembre 2016 pour une quote-part de 10.92%, à côté du dollar (41,73 %), de l’euro (30,93 %), du yen (8,33 %) et de la livre sterling (8,09 %).

Double objectif en 2016: renforcement d’indépendance et dévaluation graduelle du yuan face au dollar US

Tout laisse penser que la Chine a un double objectif : renforcer l’indépendance du yuan face au dollar et dévaluer graduellement sa devise pour soutenir son économie, qui subit un net ralentissement dont l’ampleur est difficile à mesurer.

Dans ce sens, la Chine a annoncé en décembre 2015 vouloir piloter sa monnaie vis-à-vis d’un panier de devises majeures et non plus uniquement vis-à-vis du dollar US. Elle a également demandé aux grandes banques d’instaurer des cotations de matières premières en yuan plutôt qu’en USD (la Chine est le premier acheteur mondial).

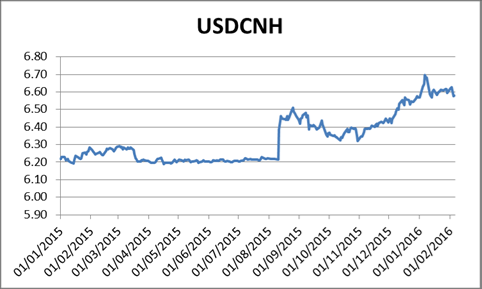

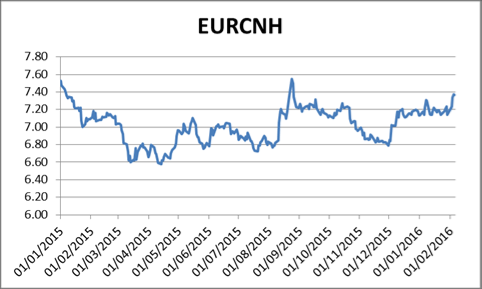

Cette volonté contribue à accroître la volatilité du renminbi contre la devise américaine et des à-coups sont à prévoir, à l’instar de la dévaluation surprise d’août dernier. Ainsi, le yuan s’est déprécié d’environ 6,5% contre le dollar US depuis août 2015 ($/CNH 6.20 à 6.60) et pourrait atteindre en 2016, selon le consensus du marché, un taux de 7. Avec le risque de voir le marché s’emballer! Morgan Stanley et Goldman Sachs, entre autres, prévoient des dévaluations successives du yuan pour les mois à venir.

Quelles conséquences pour les entreprises européennes ?

Pour les entreprises européennes, la volatilité du renminbi est une contrainte, que leurs contrats soient libellés en CNH ou dollar US. Le détachement du cours du yuan de celui du dollar signifie qu’il ne suffit plus de se couvrir en USD pour se prémunir des variations du yuan. La volatilité peut également devenir un inconvénient majeur pour les contrats libellés en devise domestique européenne s’ils ne sont pas parfaitement indexés sur le cours du CNH. En effet, si ce type de conditions semble rassurant pour les entreprises européennes, les clients ou fournisseurs chinois exigeront que les fortes variations qui leur sont défavorables soient compensées sur les prix pour conserver leur profitabilité ou juste survivre. Au final, l’entreprise européenne aura subi les mouvements défavorables majeurs sans pouvoir les couvrir, mais n’aura pas bénéficié des mouvements favorables. De plus, plusieurs études ont montré que libeller un contrat d’import en yuan pouvait permettre de réduire les prix d’achat de plusieurs pourcents, car le fournisseur est dégagé de ce risque de change qu’il n’est pas habitué à gérer.

Il semble donc judicieux, si possible, de renoncer aux contrats libellés en euros, francs suisses ou livres sterling avec des contreparties chinoises au profit du yuan et de réfléchir à des stratégies de couvertures de ce risque contre sa propre devise. En effet, les produits de couverture classiques sont disponibles pour le yuan et sont appelées à se démocratiser avec l’internationalisation de celui-ci. Et les méthodologies évoquées dans notre précédent article sur les risques de change sont applicables au renminbi.

Evolution historique des parités USD/CNH et EUR/CNH depuis 2015

KERIUS Finance (Genève – Paris) est un cabinet de conseil indépendant spécialisé en gestion de trésorerie et couverture des risques de change, taux d’intérêts et matières premières. www.kerius-finance.com

Conseiller en Investissements Financiers (CIF) immatriculé au registre ORIAS (N° 13000716) et membre de l’ANACOFI-CIF, association agréée par l’Autorité des Marchés Financiers (France).

Financial markets worried about China’s capacity to maintain economic growth and to control its currency depreciation

Bearish speculation on the yuan recently stepped up and some analysts no longer exclude the possibility of joint action between central banks to head off a crash of the Chinese currency in the months ahead.

The evolution of 3 indicators underlies this hypothesis:

- An increase in options premium on put (sell) options on the yuan.

- Tensions between the domestic yuan’s rate (CNY) controlled by the Chinese central bank and the off-shore yuan’s rate (CNH) quoted in Hong Kong: the gap between these two rates grew from 0,3 to 0,6% between November and December 2015.

- An historic drop in China’s foreign exchange reserves that are consumed by the People’s Bank of China (PBOC). Reserves dropped by $513bn in 2015 (including $108bn just in December, the biggest monthly drop since 2004) to reach $3,300bn at the end of 2015, compared to $3,990bn in June 2014. Some analysts estimate that the security threshold for the reserves is around $2800bn.

Moreover, the PBOC should carry on loosening its control on the CNY, due to the requirements of the renminbi’s integration into the IMF’s SDR (Special Drawing Rights) basket, which will take place in September 2016. The renminbi will have a 10.92% share in the basket, along with the dollar (41,73%), the euro (30,93%), the yen (8,33%) and the pound (8,09%).

A double objective for 2016: enhanced independence and gradual devaluation against the dollar.

In this new context, there is every reason to believe that China’s goal is two-pronged: to unpeg the yuan from the US dollar, and gradually devalue its currency to support its economy that is experiencing a downturn (the magnitude of which is hard to assess).

To this end, China announced in December 2015 that it wanted to pilot its currency exchange rate using a basket of international currencies and not only the dollar any longer. China also asked the country’s main bank to start quoting raw materials in CNY rather than in USD (as a reminder, China is the world biggest purchaser of raw materials).

This intent contributes to increasing the renminbi’s volatility against the USD, and other ups-and-downs are to be expected, like those that occurred in August when the PBOC surprisingly devaluated the CNY. As a result, the CNY has depreciated around 6.5% against the dollar since August 2015 (USD/CNH 6.20 to 6.60) and could reach 7 in 2016 according to the market consensus, with the risk of a market panic. Morgan Stanley and Goldman Sachs, among others, expect several devaluations of the yuan in the months ahead.

Any consequences for European companies?

For European companies, the renminbi’s exchange rate volatility is a constraint, whether their contracts are denominated in CNY or in USD. Unpegging the CNY from the USD means that it will no longer be enough to hedge in USD to offset FX risk in CNY. Volatility can also become a major downside for contracts denominated in European currencies, in case prices are not fully indexed to the renminbi’s fluctuations. Indeed, if such conditions sound reassuring for European companies, clients or suppliers in China will, on their part, demand adverse fluctuations to be compensated, in order to safeguard their profitability, or just to survive. In the end, European companies will have incurred the major negative movements without being able to hedge them, and will not have benefitted from the favorable ones.

Moreover, several studies showed that denominating suppler contracts in CNY can lower prices from Chinese suppliers by several percentage points, as they do not have to manage the FX risk. It then seems sound to waive contracts denominated in EUR, GBP or CHF with Chinese counterparts, and switch to CNY-denominated contracts, in order to hedge it against your own currency. Indeed, standard hedging products are starting to become available for the CNY, and will only be more and more common in the future with the internationalisation of the currency. Hence, the methodology we discussed in our last article could also be applied to the renminbi.

SDCNH and EURCNH exchange rates since 1st January 2015

KERIUS Finance (Geneva – Paris) is an independent advisory company specializing in treasury management and hedging of currency, interest rates and commodity risks. www.kerius-finance.com . s.rouzaire@kerius-finance.com Conseiller en Investissements Financiers (CIF) N° 13000716 at the ORIAS. Member of the ANACOFI-CIF, association accredited by the Autorité des Marchés Financiers (France).